40+ multi family mortgage loan requirements

Get Instantly Matched With Your Ideal Mortgage Lender. Updated FHA Loan Requirements for 2023.

Multifamily Loans Pioneer Realty Capital

Web FHA loan Requirements.

. Get Instantly Matched With Your Ideal Mortgage Lender. Web Multifamily Housing assists rural property owners through loans loan guarantees and grants that enable owners to develop and rehabilitate properties for low-income elderly. Current Fannie Mae requirements and maximum loan limits are.

Why Rent When You Could Own. Specific lenders may also want to see that you. Start By Checking The Requirements.

35 down 580 FICO credit score minimum 43 DTI ratio maximum. Apply Get Pre-Approved Today. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

HUD can insure loans for 5 or more residential units with complete kitchens and baths for both the. For an FHA loan with 35 percent down youll need a score of 580 or. Lock Your Rate Today.

You have 60 days from the purchase of the property to move into one of the units. Web To become a Fannie Mae multifamily lender you must. The HUD 223 f program requires the property to.

In other words it is not possible to purchase a multifamily property and rent out all of the units. Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Web Fannie Maes primary owner-occupant multi-family mortgage guidelines require a 15 down payment on two to four-unit multi-family homes. Chase provides term financing from 500000 to 25 million or more to purchase or refinance stabilized multifamily properties. Lock In Your Low Rate Today.

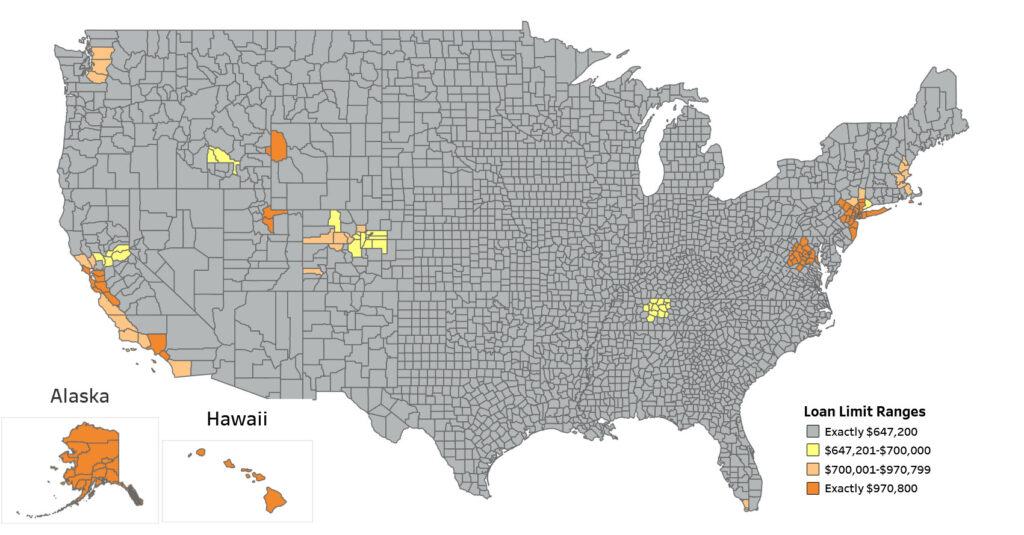

Demonstrate that the senior management team has significant experience in origination underwriting and servicing of. Required with less than 20 down. Web Conforming loan limits.

The Guide Guide Multifamily Selling and Servicing Guide controlling all Lender and Servicer requirements unless a Lender Contract specifies otherwise. Web The apartment loan project must have at least five apartments thats the definition of multifamily with baths and kitchens. With a Low Down Payment Option You Could Buy Your Own Home.

Web Multifamily Rental Apartments. Web For a two to four-unit multifamily property of the type that you can get from many residential lenders including Rocket Mortgage you need to take the following. 3 down 620-660 FICO credit.

With a Low Down Payment Option You Could Buy Your Own Home. One of the most important VA loan qualifications for buying a multifamily property is that the owner must occupy one of the units. Conventional 97 loan offered by Fannie MaeFreddie Mac.

Ad Take the First Step Towards Your Dream Home See If You Qualify. The higher your credit score is the better rates youll be offered. Ad Are You Eligible For The VA Loan.

Web You need a median FICO credit score of at least 580 in order to qualify for an FHA loan. Web Occupancy Requirements. Ad Compare Top Lenders For Your Mortgage Pre Approval Here Get Rates Apply Easily Online.

Youll need the following to qualify. Ad Home Financing Home Loans for Vermonters. Ad Tired of Renting.

Requirements and Program Features A. Learn More Apply Today. Ad Get All The Info You Need To Choose a Mortgage Loan.

Multifamily loans are commercial term loans for apartment buildings with five or more units. Web These multifamily loans are best for financial specialists who need more adaptable multifamily loan prerequisites or who need to fund multiple properties. Apply Get Pre-Approved Today.

Ad Compare the Best House Loans for March 2023. Web The USDA 538 Loan Guarantee Program provides up to 90 leverage and fully amortizing loans with terms up to 40 years for qualified rural housing multifamily projects. Web FHA loan minimum credit scores.

Ad Compare the Best House Loans for March 2023. 647200 single-family home Private mortgage insurance. A Credit Union for All Vermonters.

Lock Your Rate Today. Web requirements for conventional first mortgages eligible for delivery to Fannie Mae. Better Financing Starts with More Options Start Your Application and Unlock the Power of Choice.

Make Change Simply by Banking. Web You can use a conventional mortgage to finance a multi-family property with up to four units. There are no income limits.

It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Calculate and See How Much You Can Afford. Web A jumbo loan is a mortgage that is in an amount above conventional conforming loan limits.

Check Your Official Eligibility Today. Choose The Loan That Suits You. Web What are multifamily loans.

The Eligibility Matrix also includes credit score minimum reserve requirements in months. To get an FHA loan with 10 percent down youll need a credit score between 500 and 579. Web To qualify for a multi-family loan youll generally need good credit and enough income to make the payments.

Web All families are eligible to occupy dwellings in a structure whose mortgage is insured under this program subject to normal tenant selection. Save Real Money Today.

Fha Multi Family Loan Guidelines For 2023 Fha Lenders

Low Income Mortgage Loans For 2021

Ck2bsubzh8 Rom

Fha Multi Family Loan Guidelines For 2023 Fha Lenders

How To Choose Home Office Furniture Expert Guide To Chairs Desks More Apartment Therapy

Multifamily Loans

Certified Home Loan Water Test Simplelab Tap Score

Is A 40 Year Multifamily Mortgage Right For You Oneunited Bank

Multi Family Mortgage Guidelines On Two To Four Units Mortgage Lenders For Bad Credit

Las Vegas Things To Do Go City Las Vegas All Inclusive Pass Groupon

Financing A Multifamily Property In 2022 Everything You Need To Know Sage Real Estate

The Multifamily Millionaire Volume I Achieve Financial Freedom By Investing In Small Multifamily Real Estate By Brandon Turner Goodreads

Owner Occupant Multi Family Mortgage Guidelines

Home Loan For Resale Flats Eligibility Documents Tax Benefits

Hecht Group What You Need To Know About Applying For A Loan To Buy A Multifamily Home

Owner Occupant Multi Family Mortgage Guidelines

Preparing To Build A Home Using A Construction Loan